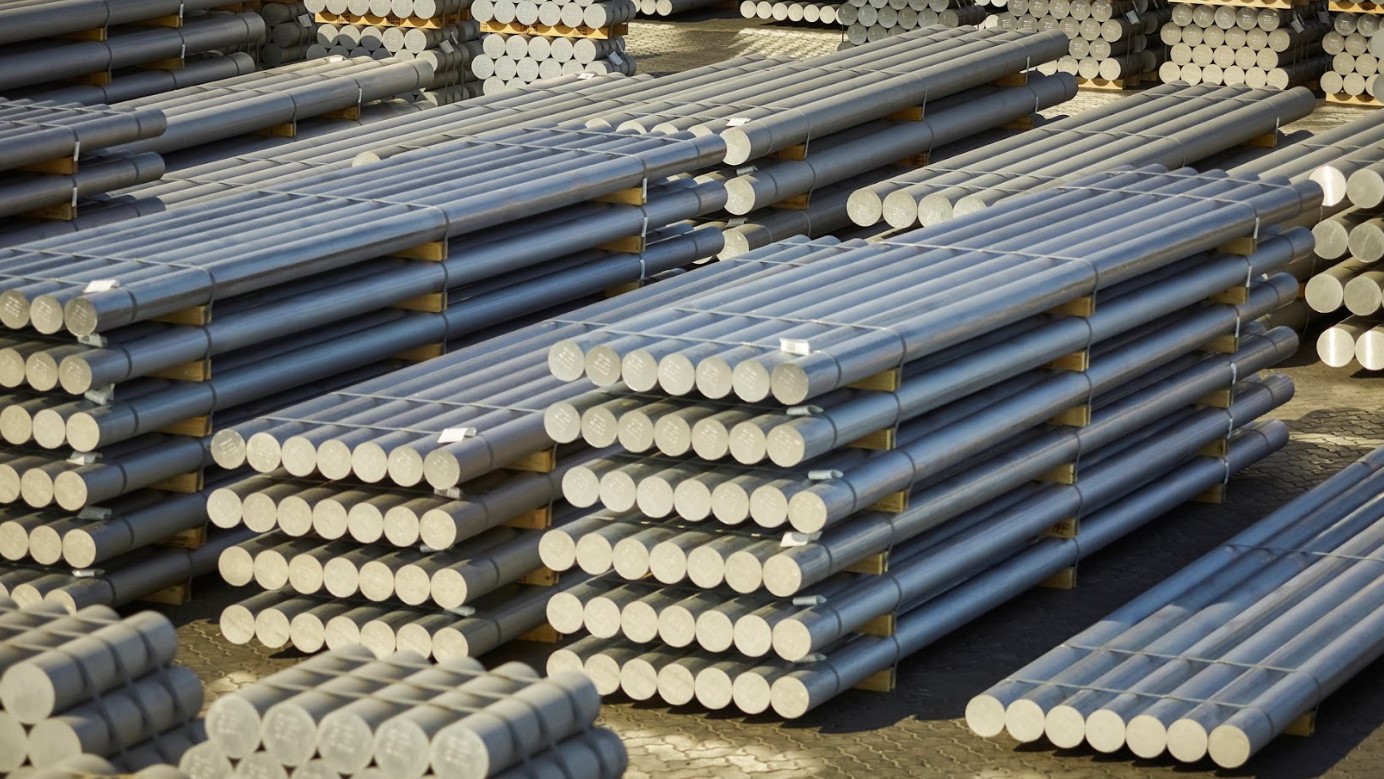

Aluminum billet price remains a pivotal concern for manufacturers, suppliers, and investors across various industries due to its direct influence on production costs and market competitiveness. As a trusted global partner in the non-ferrous metal sector, Stavian Industrial Metal provides real-time insights and reliable sourcing solutions for high-quality aluminum billets. Understanding the dynamics behind pricing—including raw material costs, global demand, energy consumption, and geopolitical factors—helps businesses make informed purchasing decisions. With fluctuating market trends, stakeholders must stay ahead of aluminum billet price changes to optimize budgets and maintain supply chain stability.

In today’s global market, the term aluminum billet price has become increasingly critical as manufacturers, suppliers, and end‑users navigate complex cost structures and supply‑chain dynamics. A billet, essentially a semi‑finished cast or extruded block of aluminium alloy, serves as the foundational input for a wide array of downstream products—from extrusions and automotive components to construction profiles. According to industry guides, billet aluminum is differentiated from cast aluminum by its processing route and resultant properties such as density and mechanical performance.

When assessing aluminium billet price, several key cost‑drivers converge: primary aluminium market price, alloying and processing premiums, energy and raw‑material inputs, inventory levels and regional logistics. Each of these components influences the final price that downstream fabricators and industrial buyers must factor into their sourcing decisions. For instance, the base aluminium price is often tied to benchmark listings such as the London Metal Exchange (LME).

Beyond the base metal, the transformation into billet incurs additional costs—for example, extruders note that “the price an extruder pays for his extrusion billet will be governed by the price on the LME plus the premium charged by the smelter for converting aluminium into billet form.”

In short, for industry professionals evaluating aluminium billet price, a holistic lens is required—covering upstream commodity markets, process‑specific premiums, downstream demand patterns and global supply‑chain logistics. Understanding these inter‑locking factors enables better budgeting, sourcing and risk mitigation strategies for bulk purchasing of aluminium billets.

The starting point for any billet pricing discussion is the price of the primary aluminium metal itself, which underpins much of the cost structure for semi‑finished products such as billets. Primary aluminium is subject to commodity forces: global supply and demand, energy costs for smelting, trading on major exchanges, and macroeconomic factors. For example, aluminium production demands substantial electricity, and fluctuations in power cost or availability directly influence the base material price.

Since the base aluminium metal is frequently traded (or referenced) via commodity contracts on the LME, this allows fabricators and billet producers to monitor benchmark pricing and anticipate changes in cost.

Once the base price moves, the price of aluminium billets typically follows—though with additional premiums or discounts depending on alloy grade, processing route, location and logistics. As a result, fabricators and buyers must track base aluminium movements to understand shifts in aluminium billet price. From a sourcing perspective, being aware of base metal trends helps stakeholders anticipate how “aluminium billet price” might move in the near term.

Beyond the basic commodity aluminium, the manufacturing of aluminium billets brings in additional cost layers. One of the critical factors is the cost of alloying elements and the type of billet processing (e.g., casting vs extrusion grade). For example, when other alloying metals (magnesium, chromium, titanium) increase in cost, then those premiums feed into the final billet price.

The manufacturing route also affects pricing. For example, billet formed via extrusion or pressurised casting may incorporate higher capital cost, tighter tolerances or additional finishing—all of which raise cost. As one source notes, extrusion profile sizes, die costs and production speeds can alter the extrusion billet cost meaningfully.

In many cases the premium payable over the base aluminium price depends directly on these processing and alloying variables. Buyers asking about “aluminium billet price” should therefore ask about:

Another major pillar in determining aluminium billet price is the interplay of supply and demand, as well as the level of inventory held in the market. When supply exceeds demand, or when downstream consumption weakens, the resulting inventory build‑up exerts downward pressure on pricing, and vice versa. For example, recent market commentary noted that in June 2025 the inventory of aluminium billets in major regions hit around 142,500 mt, and downstream operating rates were dipping into the 50% range for certain extrusion customers.

In this context, manufacturers reported strategic production cuts, yet these were still insufficient to offset weak destocking and reduced downstream orders.

From the perspective of pricing, when inventory builds and downstream orders slow, suppliers may struggle to maintain price levels and hence must either offer discounts or risk margin erosion. Conversely, when inventories tighten and demand ramps up (for example in automotive or aerospace sectors) then the billet producers may hold premiums or delay material availability—thereby elevating aluminium billet price. For purchasing professionals within fabricator environments, tracking regional inventory levels, lead‑times and utilisation rates offers critical intelligence for anticipating shifts in billet pricing.

Geographic location, logistics and regional cost structures can significantly affect the aluminium billet price paid by end‑users. Because a billet must be shipped (often heavy, dense metal) and sometimes imported/exported across borders, freight, customs duties, regional production cost differentials and local energy pricing contribute. In many markets, the premium over base metal reflects local supply‑chain considerations (transportation, import duties, port handling, local conversion costs). From extrusion fabricators, one analysis observed that the price an extruder pays depends on the LME base plus the conversion premium “charged by the smelter for converting aluminium into billet form.”

Furthermore, regional differences exist in how supply‑demand balance plays out; for example the Asian market may have different inventory dynamics compared with Europe or North America. According to a report, the global aluminium billet market is projected to grow along various regional growth rates, driven by construction, aerospace and automotive sectors.

The practical takeaway: when negotiating or forecasting aluminium billet price, it is essential to ask the supplier about cost basis (FOB vs delivered), freight charges, any duties/taxes, and differences in regional supply tightness or overcapacity. These aspects often explain why two buyers sourcing the identical billet specification pay markedly different prices based purely on location and logistics.

The end‑use application of billets plays a meaningful role in determining the appropriate price and market dynamics. Billets destined for high‑performance applications (such as aerospace, high‑strength automotive, precision extrusions) usually command higher premiums than standard commodity billets intended for general structural uses. The type of alloy series, permissable impurities, required mechanical properties and finishing tolerances all influence cost. In turn, these cost differences feed into aluminium billet price.

From a market‑growth perspective, segments such as aerospace, construction and automotive are cited as key drivers of demand for aluminium billets. For example, a market report indicates that the North American aluminium billet market was dominant in 2024 – accounting for over 40% of global revenue – due to demand from aerospace and automotive sectors.

These demand‑tail factors become critical when fabricators negotiate with suppliers: specify the intended application (and associated requirements), because the billet pricing may vary significantly based on that. Buyers often discover that “commodity/standard” billets cost materially less than premium grade ones—so clarity of application is essential. For companies like ours at Stavian Industrial Metal, educating customers about how application and specification influence aluminium billet price is part of delivering value.

Given the various inputs discussed above—base metal price, processing premiums, supply‑demand balance, regional logistics, and application demands—the future trajectory of aluminium billet price is a matter of synthesising all these moving parts. Recent trend analysis suggests that in Q4 2025, billet pricing may remain relatively stable, but volatility is possible into early 2026 as macro‑ and geopolitical factors come into play.

The key signals to monitor include:

For businesses with significant exposure to raw material costs, hedging against aluminum billet price volatility becomes a crucial part of procurement strategy. As billet pricing is closely tied to the LME base aluminum price and regional premiums, companies can use financial instruments like futures contracts, swaps, and options to mitigate potential losses from unfavorable price movements.

A common practice is to lock in a future billet price using LME aluminum futures. While this does not hedge the entire billet cost (as premiums and logistics still vary), it provides a buffer against sharp rises in base aluminum costs. For example, large manufacturers or traders may agree on a formula pricing structure that includes a fixed LME component plus a negotiated regional premium.

In addition to financial tools, companies should adopt operational strategies such as:

At Stavian Industrial Metal, we assist clients in designing tailored procurement and hedging strategies that align with their risk tolerance and market exposure, helping ensure cost predictability and supply chain resilience.

Another essential consideration when discussing aluminum billet price is the specification and quality standard required for a particular application. Aluminum billets are not one-size-fits-all; they come in various alloy grades, sizes, and treatment conditions that can significantly alter their cost.

The most commonly used alloy series for billets include:

Each series has unique production challenges and alloying elements that affect cost. Additionally, the temper (e.g., T6, T6511) and the specific diameter or cross-section of the billet may require customized molds or casting processes, adding further to production expenses.

Buyers should clearly communicate the following when requesting quotes:

These factors not only determine the technical suitability of the billet but also its final market price. Working with a supplier like Stavian Industrial Metal ensures that these specifications are aligned with international standards while keeping costs competitive.

As global focus shifts toward sustainability, environmental regulations are playing a larger role in shaping aluminum billet price. The aluminum industry is highly energy-intensive, and producers are under increasing pressure to reduce carbon emissions, adopt cleaner technologies, and comply with stricter environmental laws.

In certain regions, carbon taxes and emission trading schemes have already begun impacting the cost of aluminum production. Smelters powered by coal-based electricity often face higher compliance costs compared to those using renewable energy or hydroelectric power. These cost differences translate directly into billet pricing.

Additionally, recycled aluminum is gaining popularity as a more sustainable alternative to primary billet. While recycled billet can be cheaper, it may not always meet the high-performance standards required in aerospace or automotive applications. Still, using recycled content can help manufacturers meet environmental targets and reduce their carbon footprint.

Key factors to consider in this area include:

As a responsible global partner, Stavian Industrial Metal works closely with producers who adhere to international sustainability standards, ensuring clients can access competitively priced billets with minimal environmental impact.

The use of advanced technology in aluminum billet production also influences price. Innovations in casting, homogenization, and alloy development can enhance product performance, reduce waste, and streamline production—sometimes at higher initial cost, but often with long-term efficiency gains.

Modern billet production may involve:

These advancements contribute to higher quality billets, often with improved machinability, extrusion characteristics, and strength-to-weight ratios. However, incorporating such technologies may increase capital and operational expenditure, which gets reflected in aluminum billet price.

For buyers focused on high-performance applications or seeking process efficiency, the slight price premium for technologically advanced billets may be justified by enhanced downstream productivity. At Stavian Industrial Metal, we help clients evaluate the cost-benefit profile of various manufacturing technologies and select billet solutions that meet their specific performance and budget requirements.

Selecting the right supplier is one of the most influential decisions impacting aluminum billet price and overall procurement success. Beyond cost, factors like supplier reliability, capacity, lead time, compliance with standards, and after-sales support are critical to consider.

A good supplier should offer:

Engaging in long-term partnerships with reputable suppliers can lead to preferential pricing, priority during shortages, and access to technical expertise that short-term or transactional relationships cannot offer.

Stavian Industrial Metal combines these attributes with a global sourcing network, enabling us to deliver consistent quality billets at competitive prices. Our extensive supplier vetting process ensures that every billet meets stringent performance, safety, and environmental standards.

Looking ahead, aluminum billet price will continue to be shaped by a combination of macroeconomic trends, regional developments, and technological shifts. Some of the forecasted trends influencing pricing over the next few years include:

Stakeholders involved in long-term procurement or investment planning must remain agile and well-informed. Strategic steps to navigate this landscape include:

As global demand for lightweight, durable, and sustainable materials grows, aluminum billets will remain central to numerous industries. Stavian Industrial Metal is committed to providing our clients with not only high-quality materials but also the market intelligence and strategic support they need to make informed decisions in a rapidly evolving marketplace.

Learn more

What Is U-shaped Aluminum Profile? Characteristics, Applications and Price

Aluminum Extrusion 20×20: A Versatile Square Profile

High-Quality Aluminum Bars for Structural and Industrial Use

Address

Website: https://stavianmetal.com

Email: info@stavianmetal.com